Maximum Cpp Contribution 2024. For 2024, the maximum pensionable earnings under the canada pension plan (cpp), for employee and employer is 5.95% (2023: Employer and employee cpp contribution rates for 2024 will remain at 5.95%, and the maximum contribution will be $3,867.50 each, up from $3,754.45 in.

Starting from january 1, 2024, the maximum pensionable earnings under the cpp will see an increase to $68,500, up from $66,600 in 2023. As a result, the maximum cpp contribution for 2024 will reach $3,867.50 for employees and employers.

Maximum CPP Contribution for 2024 A Complete Analysis MyBikeScan, With the beginning of the. The employee and employer cpp.

CPP Maximum Pensionable Earnings Increased to 68,500 in Year 2024, For 2024, the maximum pensionable earnings under the canada pension plan (cpp), for employee and employer is 5.95% (2023: Beginning january 1, 2024, you must deduct the second additional cpp contributions (cpp2) on.

Significant HSA Contribution Limit Increase for 2024, Employer and employee cpp contribution rates for 2024 will remain at 5.95%, and the maximum contribution will be $3,867.50 each, up from $3,754.45 in. Check the details about the maximum cpp contribution 2024:

2023 CPP Payment Schedule, Amounts, and Increases (2023), The maximum pensionable contribution for the base component of cpp increases to $68,500 in 2024 from $66,600 in 2023. For 2024, that means a maximum $188 in additional payroll deductions.

大晟文化2018年巨亏11.3亿,蒋劲夫家暴事件殃及《米露露求爱记》 知乎, For 2024, the maximum cpp payout is $1,364.60 per month for new beneficiaries who start receiving cpp at 65, while the average cpp in october 2023. The employee and employer cpp.

What Is The Max Hsa Contribution For 2022 2022 JWG, March 14, 2024 by andrew. The employee and employer cpp.

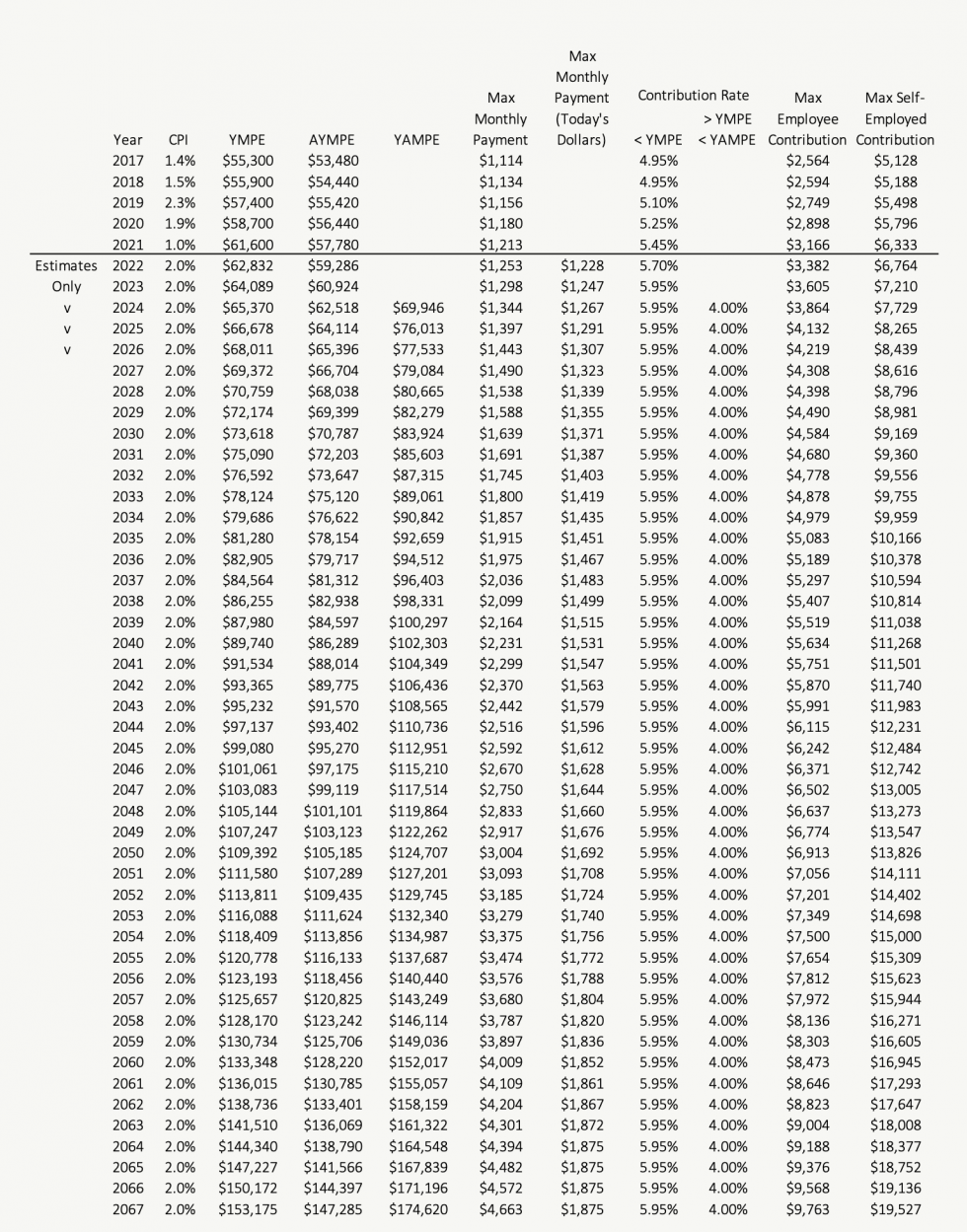

The CPP Max Will Be HUGE In The Future PlanEasy, For 2024, the maximum pensionable earnings under the canada pension plan (cpp), for employee and employer is 5.95% (2023: For 2024, that means a maximum $188 in additional payroll deductions.

CPP EI Calculations 2022 and 2023 FinTech College of Business And, Any amount you earn above $3,500 up to $68,500 ( maximum annual pensionable earnings for 2024) is subject to a cpp deduction of 5.95%. For instance, the 2023 maximum limit is $66,600.

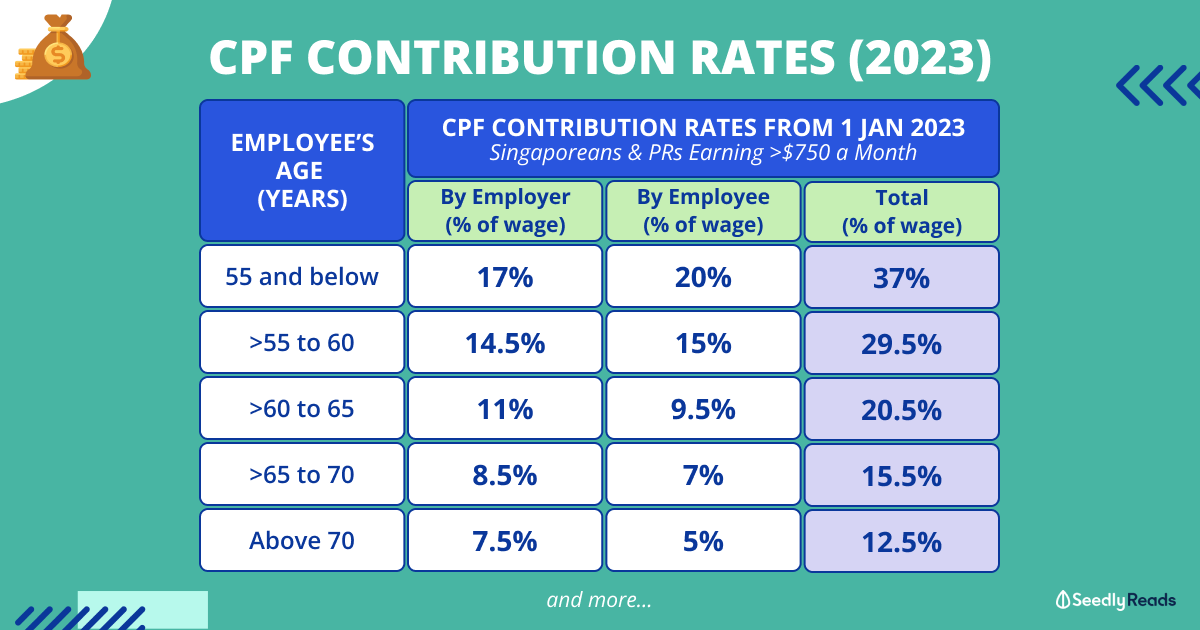

CPF Contribution Rates 2023 All You Need To Know About the Latest, Cpp payments are made monthly, and the. In this article, we will cover everything you need to know about the cpp and ei rates in canada for 2024, including the cpp contribution rates, maximum limits,.

2023 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, For 2024, the maximum cpp payout is $1,364.60 per month for new beneficiaries who start receiving cpp at 65, while the average cpp in october 2023. The maximum pensionable contribution for the base component of cpp increases to $68,500 in 2024 from $66,600 in 2023.